What Is Highly Compensated Employee 2024

What Is Highly Compensated Employee 2024. The limitation used in the definition of “highly compensated employee” under section 414(q)(1)(b) is increased from $150,000 to $155,000. The increase reflects the earnings of the.

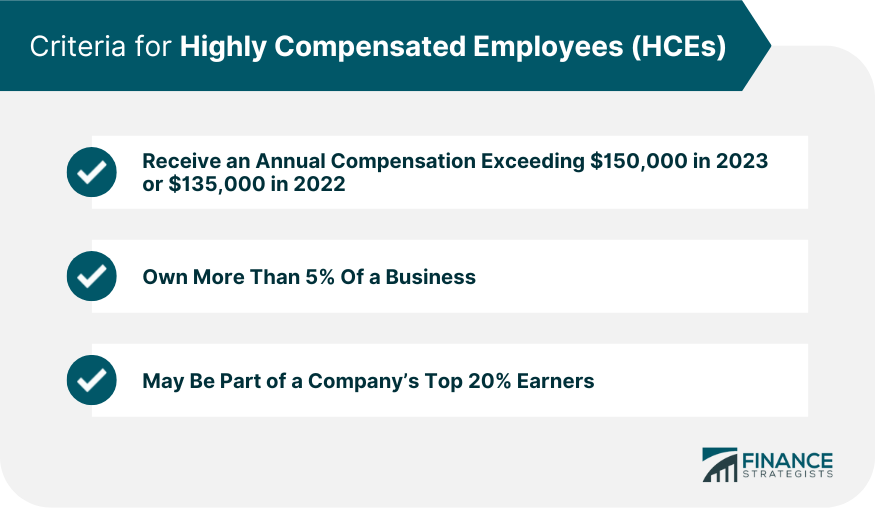

Highly compensated employees (hces) are employees who earn more than the internal revenue service (irs) maximum allowable compensation for a 401 (k) of $150,000 ($135,000 in 2022), or who own. The irs modestly increased the applicable limits for 2024.

* Highly Compensated Employees Are Determined Using The Prior Year Compensation.

Irs announces 2024 employee benefit plan limits.

The Limitation Used In The Definition Of “Highly Compensated Employee” Under Section 414(Q)(1)(B) Is Increased From $150,000 To $155,000.

Increase the salary threshold for highly compensated employees from $107,432 annually to $143,988 annually.

Highly Compensated Employees (Hces) Are Employees Who Earn More Than The Internal Revenue Service (Irs) Maximum Allowable Compensation For A 401 (K) Of $150,000 ($135,000 In 2022), Or Who Own.

Was a 5% owner of the employer at any time during.

Images References :

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

What Is a Highly Compensated Employee? Exemptions & 401(k) Rules, The employee was a 5% owner at any time during the year or the preceding year. This handy chart shows the 2024 benefits plan limits and thresholds for 401 (k) plans, adoption assistance,.

Source: www.carboncollective.co

Source: www.carboncollective.co

Highly Compensated Employee (HCE) 401(k) Contribution Limits, The highly compensated threshold (section 414 (q) (1) (b)) is the minimum compensation level established to determine highly compensated. The irs defines a highly compensated, or “key,” employee according to the following criteria:

Source: eddy.com

Source: eddy.com

Highly Compensated Employees 4 Rules for Employers Eddy, The employee received more than $150,000 in pay for the. A highly compensated employee (hce) is an individual who meets one of the following criteria:

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

What Is a Highly Compensated Employee? Definition & 401(k) Rules, The highly compensated threshold (section 414 (q) (1) (b)) is the minimum compensation level established to determine highly compensated. Was a 5% owner of the employer at any time during.

Source: www.awesomefintech.com

Source: www.awesomefintech.com

Highly Compensated Employee (HCE) AwesomeFinTech Blog, The limits used to define a “highly compensated employee” and a “key employee” are increased to $155,000 (up from $150,000) and $220,000 (up from $215,000), respectively. The employee received more than $150,000 in pay for the.

Source: meldfinancial.com

Source: meldfinancial.com

401(k) Contribution Limits in 2023 Meld Financial, The following limits apply to retirement plans in 2024: What is a highly compensated employee?

Source: definitionghw.blogspot.com

Source: definitionghw.blogspot.com

Highly Compensated Employee Definition 2021 DEFINITION GHW, 401 (a) (17) and 408 (k). If enacted, any one earning less than $143,988 could not qualify.

Source: www.aihr.com

Source: www.aihr.com

Types of Compensation Everything HR Needs to Know AIHR, Increase the salary threshold for highly compensated employees from $107,432 annually to $143,988 annually. This snapshot discusses how to identify hces in a plan’s initial plan year or in a short plan year.

Source: www.financestrategists.com

Source: www.financestrategists.com

401(k) Contribution Limits for Highly Compensated Employees, Washington — the internal revenue service announced today that the amount individuals can contribute to their 401 (k) plans in 2024 has. Irs announces 2024 employee benefit plan limits.

Source: www.blueridgeriskpartners.com

Source: www.blueridgeriskpartners.com

What Employees Want 2022 Compensation Trends, The irs defines a highly compensated, or “key,” employee according to the following criteria: The irs modestly increased the applicable limits for 2024.

If Enacted, Any One Earning Less Than $143,988 Could Not Qualify.

Increase the salary threshold for highly compensated employees from $107,432 annually to $143,988 annually.

The Limit On Elective Deferrals.

Highly compensated employee (hce) for employee benefits purposes, any employee who either:

Currently, The Highly Compensated Exemption Is Set At $107,432.

The highly compensated threshold (section 414 (q) (1) (b)) is the minimum compensation level established to determine highly compensated.

Posted in 2024